Grisham

Ensuring Transparency

Sega's COVID recovery continues as sales rise 15.6% to $2.5bn

Sega has released its full-year results, showing a significant increase in sales and profits as the company's non-games…

The recovery of Cyberpunk 2077 continues as CD Projekt reveals the release of the next-gen version resulted in a profit surge during the first quarter of this year.

The Polish games firm released its financial results for the three months ended March 31, 2022 last night. Here's what you need to know:

The numbers

Revenue: 216.1 million PLN ($50.4 million) up 9% year-on-year

Operating costs: 83.2 million PLN ($19.4 million), down 10%

- CD Projekt Red revenues: 179.3 million PLN ($41.8 million)

- GOG revenues: 40.4 million PLN ($9.4 million)

Earnings before interest and tax: 85.3 million PLN ($19.9 million), up 98%

Net Profit: 68.9 million PLN ($16.1 million) - more than double the net profit of Q1 2021, up 112%

Net Profitability: 31.9%, up from 16.4%

.jpg?width=1200&height=630&fit=crop&enable=upscale&auto=webp)

Intel's Accelerated Computing Systems and Graphics Group (AXG), which is responsible for its line-up of Alchemist graphics cards, has lost the company $507 million in the past three months. That is markedly more than it lost in Q1, 2021 which came in at $168 million.

A big chunk of that cash is caught up in "inventory reserves and roadmap investments", Intel explains. Alchemist is yet to hit the shelves anywhere outside of China, and may be further delayed according to recent leaks from YouTuber Moore's Law Is Dead (opens in new tab), yet inventory is building up ready for a release at some point.

Now that sort of build-up of inventory is to be expected for a major product launch, but it has coincided with one of Intel's worst financial reports in years. The company posted revenue of $15.3B (opens in new tab), which is down 17% year on year and $2.7B below the expected outlook.

Alchemist wouldn't have done much to plug that hole, but a timely release may have gone a long way to making Intel's big push into graphics appear a lot more worthwhile for shareholders.

"The sudden and rapid decline in economic activity was the largest driver of the shortfall, but Q2 also reflected our own execution issues in areas like product design, DCAI, and the ramp of AXG offerings," CEO Pat Gelsinger says (via Seeking Alpha ).

Intel is having to lower its expectations for AXG, stating that it will "not hit our GPU unit target."

He also elaborates slightly on why Intel hasn't been able to deliver Alchemist in a timely fashion, noting "COVID-related supply chain issues and our own software-readiness challenges caused availability delays that we continue to work to overcome."

There is some positive news, however, and it's not just that by comparison Meta's Reality Labs division's losses (opens in new tab) make AXG's appear small fry.

"We remain on track to deliver over $1 billion in revenue this year. In Q2, we started to ramp Intel Arc graphics for laptops and OEMs, including Samsung, Lenovo, Acer, HP and Asus…. Intel Arc A5 and A7 desktop cards will start to ship in Q3," Gelsinger says.

Yet what state these cards will be in when they do release is another thing entirely.

Those software-readiness challenges are a common theme in reviews of the Intel Alchemist A380 GPU available in China today. Wolfgang Andermahr of Computer Base (opens in new tab) reviewed the card and said of the drivers: "This is currently so bad that it is hard to believe that Intel will be able to raise the quality to a usable level in the next few months."

Intel's faltering GPU launch has only made matters worse as it reports rare loss

The Intel group in charge of graphics lost over half a billion dollars in the past three months.www.pcgamer.com

The June launch of Diablo Immortal was not enough to pull Activision Blizzard out of its recent malaise, as the publisher posted its second quarter results today, showing double-digit declines, to revenues, net income, and players.

Activision Blizzard Q2 numbers

Revenue: $1.64 billion (down 28% year-on-year)

Bookings: $1.64 billion (down 15%)

Net income: $280 million (down 68%)

Monthly active users: 361 million (down 12% year-over-year and 3% quarter-over-quarter)

Activision

The Activision division continued to show declines with revenues down 38% year-over-year to $490 million, and engagement continuing to slide.

For the quarter, Activision reported 94 million monthly active users, down 26% year-over-year and 6% quarter-over-quarter. It is also the lowest total for the division since the launch of Call of Duty Mobile in October of 2019.

The publisher said Call of Duty: Vanguard and Call of Duty: Warzone had improved from their first quarter performances, but console and PC bookings for the franchise were still down year-over-year.

Meanwhile, Call of Duty Mobile's performance was more or less steady.

Blizzard

Despite the arrival of Diablo Immortal and growth from Hearthstone, Blizzard net revenues were still down 7% year-over-year to $401 million.

The company attributed the drop to a tough comparison against last year's second quarter debut of Burning Crusade Classic.

However, the Diablo Immortal launch did have some positive impact on the division, as the free-to-play mobile game helped push its monthly active users to 27 million, up 4% year-over-year and 23% quarter-over-quarter.

That marks the first time in eight quarters that Blizzard has seen its monthly active user numbers increase from the quarter prior. (The first quarter's 22 million monthly active users was the lowest for Blizzard since the company began reporting the figure in 2016.)

However, that engagement boost might still fall short of some people's expectations. For reference, the October 2019 debut of the free-to-play Call of Duty Mobile saw Activision's monthly active users go from 36 million one quarter to 128 million the next.

King

King was the only division to post growing sales this quarter, with net revenue up 8% to $684 million.

It managed that feat despite lesser engagement, with monthly active users of 240 million, down 6% year-over-year and 4% quarter-over-quarter.

The company cited Candy Crush as a driver of growth once again, with the number of paying players up double-digit percentages year-over-year.

Candy Crush has been the top-grossing game franchise in US app stores for 20 quarters running, according to Activision Blizzard.

Looking ahead

In light of the pending Microsoft acquisition, Activision Blizzard did not have an investor conference call or release guidance.

However, it did give some indication of its expectations, saying revenue and earnings per share will likely continue to show year-over-year declines in the second half of the year, while it expects operating income at least to show year-over-year growth starting in the fourth quarter.

It also emphasized its pipeline of impending releases for the rest of the year, including Call of Duty Modern Warfare 2, Call of Duty: Warzone 2.0, World of Warcraft: Wrath of the Lich King Classic, World of Warcraft: Dragonflight, and Overwatch 2.

It reiterated that Diablo 4 is slated for a 2023 launch.

Despite a downturn in the financial fortunes of many publishers, Electronic Arts continues to show growth thanks in large part to its sporting efforts.

The company today reported results for the first quarter of its fiscal year (three months ended June 30), showing sales and profit growth driven by its F1 and FIFA franchises.

Electronic Arts Q1 numbers

Revenue: $1.77 billion (up 14% year-on-year)

Bookings: $1.3 billion (down 3%)

Net income: $311 million (up 52%)

"Our FIFA franchise and the successful launch of F1 drove our net bookings outperformance, delivering another quarter ahead of expectations," said EA CFO Chris Suh.

EA reported growing engagement across a number of FIFA efforts, with FIFA Mobile seeing record quarterly daily active users, FIFA Ultimate Team seeing a 40% jump in year-over-year daily and weekly average player counts, and FIFA Online posting unspecified record engagement numbers.

The F1 series also delivered net bookings ahead of EA's expectations.

Beyond those efforts, EA's year-over-year numbers were also boosted by the acquisition of Golf Clash developer Playdemic, a deal that closed in the publisher's second quarter last year.

Company-wide, EA reported 600 million active EA accounts, up 3% quarter-over-quarter.

EA also reiterated its previous guidance for the full fiscal year, and announced a quarterly cash dividend of $0.19 a share that would be paid out to shareholders next month.

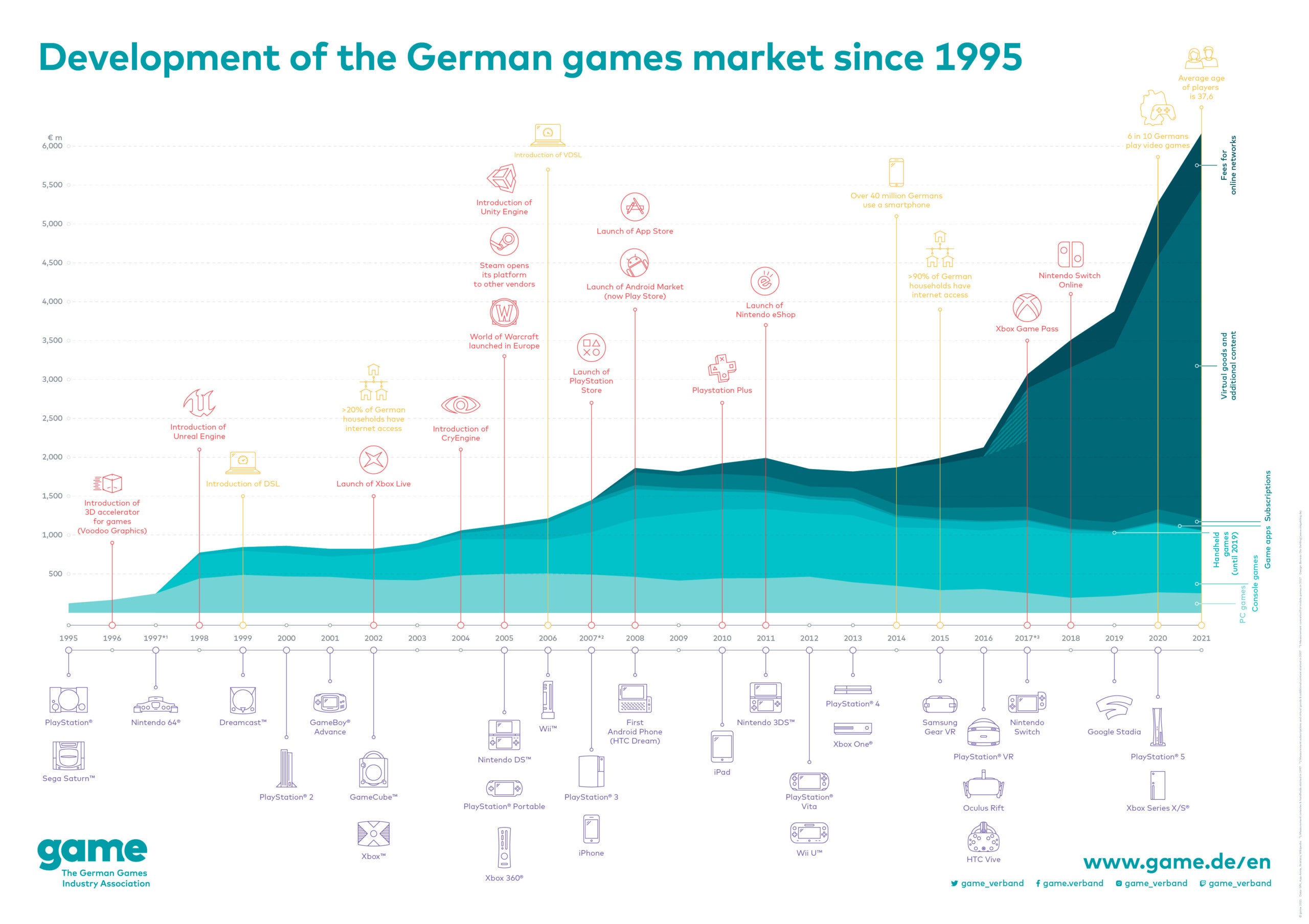

The popularity of game downloads in Germany continued to grow last year, with 59% of all PC and console purchases made digitally.

According to the German games trade body Game, 93% of all PC titles were purchased and downloaded online, while 7% were bought physically.

On the console side however, 36% of game purchases were made digitally, with the majority still preferring to buy boxed copies of games for Xbox, PlayStation and Nintendo Switch. The German games market also saw a rise in revenues during 2021; sales revenues driven by games, games hardware and fees for online gaming services saw a 17% rise to around 9.8 billion euros.

Chinese giant Tencent released its financial earnings for the period ending on June 30, reporting declines in revenue among its international and domestic game divisions.

By the numbers:

- Total revenue was RMB 134.0 billion ($20 billion), a decrease of 3% year-over-year

- Profit for the period was RMB 19.2 billion ($3 billion), a decrease of 55% year-on-year

- International Games revenue was RMB 10.7 billion ($ 1.6 billion), down 1% year-over-year

- Domestic Games revenue decreased 1% to RMB 31.8 billion ($4.7 billion), a decrease of 1% year-on-year

International Games:

The firm explained its international games revenue decline by saying the entire industry "experienced a post-pandemic digestion period" as players started to resume outdoor and offline pursuits.

While its titles PUBG Mobile and Brawl Stars saw decreases in their earnings, Valorant grew revenues and posted a record-high for monthly active users during the quarter.

Additionally, Tencent noted that V Rising, which was released in Early Access during May, brought in "incremental revenues" as it sold 2 million copies.

Domestic Games:

Tencent said that its domestic games also experienced a decline by a post-pandemic transitional period.

The Chinese games market saw fewer AAA title releases, lower consumer spending, and continued restrictions on gaming by minors.

The firm did note that its titles Honor of Kings and Peacekeeper Elite were the two top earning games during the quarter.

In recent business news, the firm announced a partnership with Logitech to create a handheld cloud gaming console, which is slated to release later this year.

Embracer Group has released its financial results for Q1 of the fiscal year, reporting a 107% increase in sales revenue as its acquisitions spree continues.

For the quarter ended June 31, the Swedish giant reported net sales of SEK 7.1 billion ($682 million) up from SEK 3.4 billion ($298 million) during the same period last year. It noted that this growth was predominantly driven by inorganic growth via subsidaries bought in the last year.

Embracer's mobile games segment saw the most significant increase, sales for the quarter were up by 104% to SEK 1.4 billion ($134 million). This was driven by subsidiary Easybrain as well the acquisition of hypercasual outfit CrazyLabs in August 2021.

The firm's entertainment and services segment also increased by 44% to SEK 671 million ($64.4 million), largely driven by the acquisition of Dark Horse in December last year.

Embracer's organic growth for the quarter was -12%, but the firm expects to see between 20 and 35% organic growth for the rest of the year with some significant boosts from the launch of Saints Row this month, and Gearbox's royalties on Tiny Tina's Wonderlands, which launched in March.

German gamers spent more on video games, hardware and accessories in 2021 than in any previous year, with total spending reaching €9.8 billion.

This figure was revealed by the 2022 annual report from Game, the trade body for Germany's games industry, which showed revenues for games products rose 17% over the already-breaking levels seen in 2020.

As such, Germany remains the largest video games market in Europe and the fifth largest in the world.

The German games market

Revenues

Software: €5.4 billion, up 19% year-on-year

Hardware: €3.6 billion, up 18%

Online and subscription services: €719 million, up 4%

That deeper blue area on the right of the graph really shows you what's driving the industry revenue these days.

In an interview with GamesIndustry.biz today at Gamescom, Bandai Namco Europe's COO Arnaud Muller addressed the impact of the current acquisition spree in games on smaller publishers.

While acknowledging that Bandai Namco is in an privileged position, Muller said that the company has to implement measures to safeguard its partnerships and IPs, while smaller publishing outfits might suffer more directly from this consolidation trend.

"What I find is that we have to secure the IPs that we create with the studios we partner with," he said. "When we invest in IP creation, when we invest in marketing for these IPs, we also have to keep in mind that we have to get some sort of security towards the future of the studio that develops this IP, if the IP doesn't belong to us.

"So this is something that we work on. You know, this spread of acquisition that we're seeing is affecting some of the smaller publishers in their capacity to access the best studios in the world. But we at Bandai Namco have the financial means to secure these partnerships.

"We work on a number of measures to secure those partnerships -- you're talking first option rights, you're talking IP ownership, you're talking minority stakes in those studios. So there are ways to secure the relationships."

Bandai Namco is the publisher behind The Dark Pictures Anthology from developer Supermassive, which was acquired by Nordisk last month. The Dark Pictures IP belongs to Supermassive but Muller assured us this "doesn't change anything in the relationship" with Bandai Namco as Nordisk is not a games publisher.

Bandai Namco is also the publisher of the Little Nightmares franchise – of which it owns the IP – with its developer Tarsier acquired by Embracer in 2020.

Starbreeze has posted its financial results for the three months ended June 30th, 2021, with the studio continuing to make a loss as development on Payday 3 continues.

The numbers

- Net sales: SEK 31.8 million ($2.9 million), 0.8% decrease year-over-year

- EBITDA: SEK 18.1 million ($1.6 million) up from SEK -51.8 million ($4.8 million) in Q2 2021

- Net loss: SEK -11.2 million ($1 million), down from SEK -76.4 million (-$7.1 million) in Q2 2021

The highlights

Looking further into Starbreeze's Q2 financials, a large majority of sales were driven by the Payday franchise, which accounted for SEK 30 million ($2.8 million) during the three months, 96.5% of the total net sales figure.

During the quarter, PC sales saw a 9% decrease to SEK 24.7 million ($2.3 million), while console sales saw a 19% increase to SEK 5.5 million ($500,000).

The firm noted that Payday 2 sales declined by more than 25% at the start of the quarter, and added that it expects to see a decline during Q3 also. Starbeeze cited a high number of competing game releases in the first half of the year as a reason for the drops.

While net sales improved slightly, the developer is still running at a net loss, albeit a smaller loss than the same period last year.

Starbreeze also noted that it began development of a new game IP during the quarter, with a view to release in 2025.

Development on Payday 3 is still underway and on track to launch in 2023, following a €50m publishing deal with Plaion (formerly Koch Media).

A new Sensor Tower report says that the top 1% of global game publishers generated $27 billion during H1 2022.

The 460 companies made up 93% of consumer spending during the first six months of the year.

Whereas the remaining 7% of mobile gaming market earnings totaled $2 billion within the same period.

Sensor Tower said that the revenue was amassed collectively from 46,000 game publishers.

Additionally, the analytics firm said that for gaming and non-gaming apps, the top 1,800 publishers made up 91% of all H1 2022 revenue.

They accumulated a total of $42 billion within the first half of the year.

The remaining 9% of the market share was $4 billion generated from consumer spending.

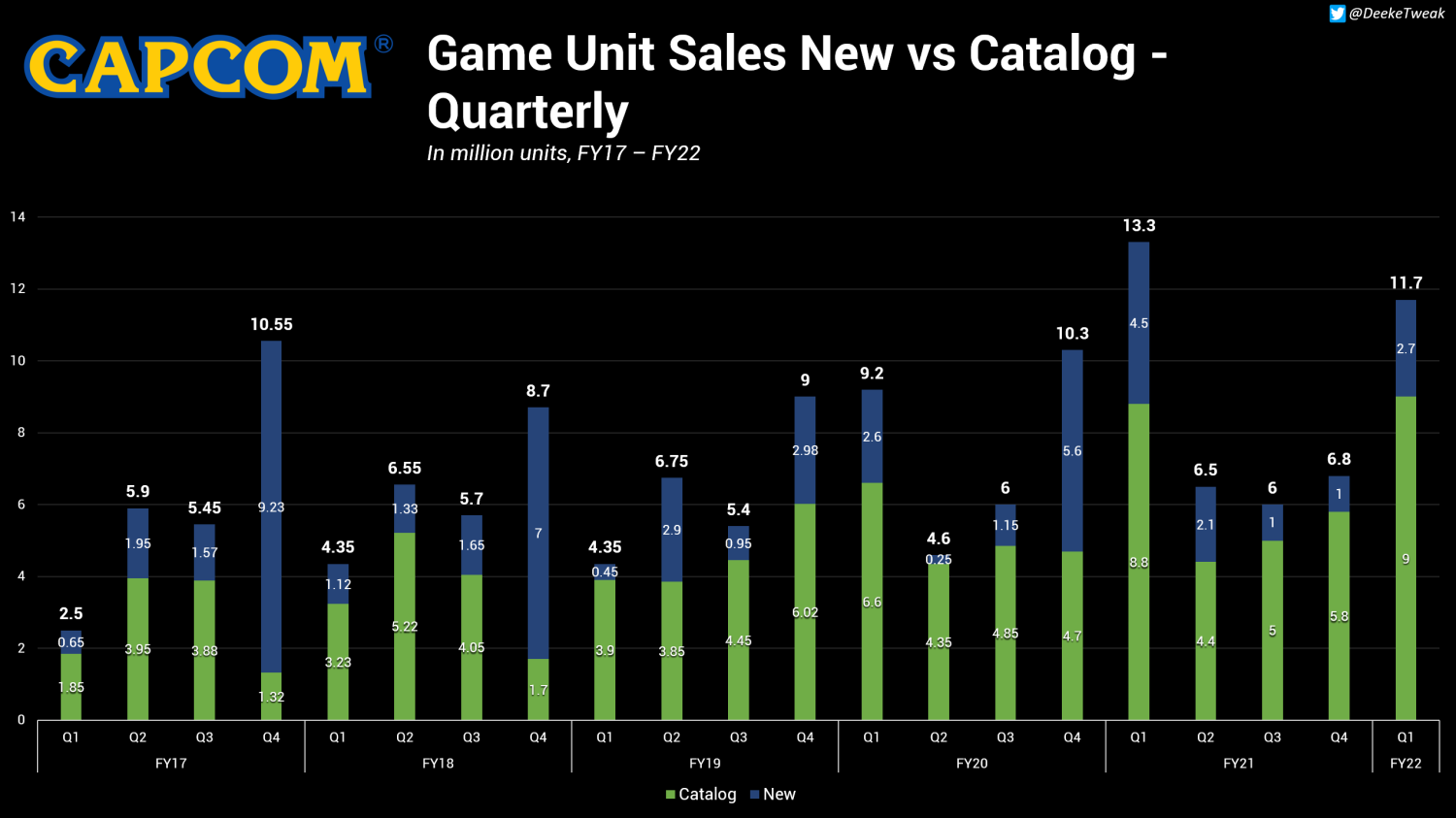

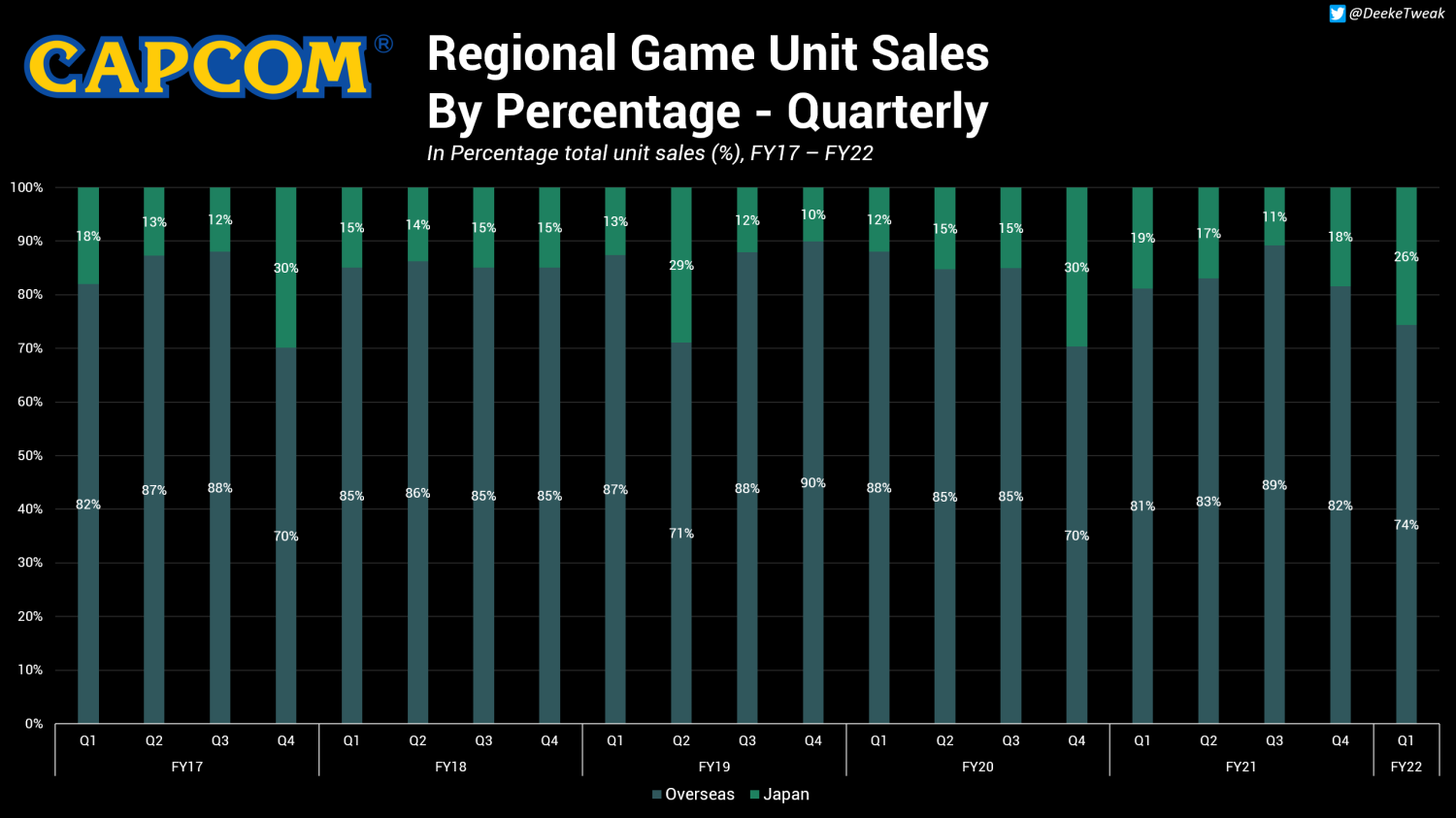

Capcom says it's continuing its march towards ten years of consecutive operating income growth, despite another quarter of declining sales revenue.

For the three months ended September 30, 2022, net sales were down 29.9% YoY at 49,067m yen, operating income down 24.3% at 21,895m yen, and ordinary income down 22.6% at 22,996m yen.

The company again attributed the decline to the release of "a new major title" in the same period of the previous year, likely to be Resident Evil Village.

Although operating income for the first 6 months of Capcom's fiscal year is currently down 25% year-on-year (21,895m yen vs. 28,924m yen), the company said it intends to make up for this in the remaining half to achieve ten consecutive years of growth.

During its latest quarter, Capcom sold 21.3 million units of game software, marking a year-over-year increase. The company achieved this with the release of Monster Hunter Rise: Sunbreak, as well as through digital sales, including sales of catalog titles composed primarily of entries in major series, such as Monster Hunter Rise.

Monster Hunter Rise: Sunbreak has topped 4.4 million units cumulatively, Monster Hunter Rise surpassed 11 million units, and Resident Evil 2 has now exceeded 10 million units sold.

Based on progress during the first half of the fiscal year, Capcom has raised its forecast for the current fiscal year ending March 31, 2023.

| MEUR, IFRS, Group, unaudited | 7–9/2022 | 7–9/2021 | 1–9/2022 | 1–9/2021 | 1–12/2021 |

| Revenue | 7.9 | 7.4 | 30.0 | 24.9 | 44.7 |

| Growth in revenue, % | 6.8% | -29.7% | 20.2% | -7.3% | 8.9% |

| EBITDA | -2.4 | 0.4 | -0.9 | 3.6 | 14.5 |

| Operating profit (EBIT) | -3.0 | -0.2 | -2.7 | 1.1 | 11.4 |

| Operating profit, % of revenue | -38.4% | -2.9% | -9.0% | 4.3% | 25.5% |

| Result for review period | -2.6 | -0.4 | -3.2 | 0.6 | 8.8 |

| Result for review period, % of revenue | -33.5% | -4.8% | -10.7% | 2.5% | 19.7% |

| Balance sheet total | 98.9 | 93.1 | 98.9 | 93.1 | 101.1 |

| Cash flow from operations | 4.7 | 4.8 | 14.2 | 8.2 | 6.1 |

| Net cash | 57.5 | 57.3 | 57.5 | 57.3 | 52.8 |

| Cash position | 56.5 | 57.0 | 56.5 | 57.0 | 51.4 |

| Net gearing, % | -66.9% | -73.1% | -66.9% | -73.1% | -60.4% |

| Equity ratio, % | 86.9% | 84.1% | 86.9% | 84.1% | 86.4% |

| Capital expenditures | 2.8 | 2.7 | 8.1 | 7.3 | 9.6 |

| Average number of personnel during review period (FTE) | 316 | 286 | 302 | 280 | 280 |

| Headcount at the end of period | 330 | 294 | 330 | 294 | 294 |

| Earnings per share, € | -0.20 | -0.03 | -0.24 | 0.05 | 0.66 |

| Earnings per share, € (diluted) | -0.19 | -0.03 | -0.23 | 0.04 | 0.63 |

| Number of shares at the end of period | 13,448,600 | 13,072,150 | 13,448,600 | 13,072,150 | 13,298,450 |

In the third quarter of 2022, revenue grew by 7% to EUR 7.9 million. Development fees made up 95% and royalties 5% of the revenue. Key positive contributors were the development fees from Alan Wake 2 and Max Payne 1&2 Remake. At the same time, development fees from Codename Condor and Alan Wake Remastered and game royalties from Control decreased from the comparison period. Alan Wake Remastered and Crossfire did not generate royalties.

In the third quarter, operating profit decreased to EUR -3.0 (-0.2) million. Our result was burdened by significantly increased external development expenses, mainly related to Alan Wake 2 and Codename Condor. The lower share of higher-margin royalty revenue also affected profitability.

During the past years, we have successfully shifted into a multi-project model. Our game development capabilities are better than ever, our financial position is strong, and we have the right business partnerships for each of the five games in development. Four of these games are based on Remedy-owned brands and one is based on an external brand with a great strategic fit for us.

Japan's PC gaming market has roughly doubled in three years, growing to nearly $896 million US between 2018 and 2021. The user base of active PC gamers has increased by 5 million from 2015 to 2021, with 4.5 million of those playing exclusively on PC—up more than 100% from 2015's 2.2 million PC-exclusive Japanese gamers.

The new data comes from the latest report by Japanese game industry think tank Kadokawa ASCII Research Laboratories, a well-regarded publication which compiles yearly material about the performance of the gaming industry both domestically in Japan and abroad. Such clear data on growth in the industry will come as a surprise to many who've yet to discard the old wisdom that PC Gaming in Japan is a small niche.

The information comes from game industry analyst Dr. Serkan Toto, whose comparison (opens in new tab) of the 2021 data to historical numbers from the same reporters highlights such significant growth. Toto is a German national, but has been based in Tokyo since 2004 and has worked as a game industry consultant at his company, Kantan Games, since 2013.

Toto attributes the huge growth to a storm of separate factors separately contributing to a single outcome. Toto cites the effect of Coronavirus lockdowns, lack of PS5 console availability in Japan, growing acceptance of foreign and indie games available cheaply on PC, much greater availability of Japan-made games on PC, and availability of popular Smartphone games at launch on PC. Toto also cites improvement in the quality of not just local PC gaming storefronts, but Steam's Japanese version—which was once "terrible" but have improved, with physical Steam wallet cards now widely available.

"nNot every point set the PC gaming market in Japan on fire by itself," writes Toto, "but the individual factors combined certainly have been and still are self-reinforcing themselves over time. I believe the trend to a bigger PC game industry in Japan will continue in the next several years."